The General Securities Representative Examination, often known as the Series 7 Exam, is one of the most common and in-demand credentials in the financial sector. It gives those who want to operate as registered representatives or stockbrokers a significant stepping stone and enables them to sell and buy a variety of financial goods.

Deep knowledge of numerous financial products, investing techniques, regulatory requirements, and ethical practices is necessary for the successful completion of the Series 7 test. This study manual has been specially created to assist you in confidently navigating through the test curriculum and to give you useful practice resources to improve your knowledge and exam preparedness.

Did you know?

There are 125 multiple-choice questions on the exam (reduced from 250), and there are four possible answers for each. There are 10 additional unlisted pretest questions on each candidate’s exam, but they don’t count toward the candidate’s grade. All of the exam’s questions, including the pretest ones, are allocated at random. Thus, a total of 135 questions—125 scored and 10 unscored—will be presented to each applicant.

You will journey through the essential concepts covered in Series 7, covering investment risk, equity and debt securities, options, mutual funds, and industry regulations. To support your learning and assess your command of the content, we will offer succinct explanations, real-world examples, and practice problems.

We will cover the essential material as well as any new updates or modifications that may have been made to the test after its release in October 2018. Success requires keeping up with the most recent knowledge.

Question Types Explained

Each of the 125 multiple-choice questions on the exam has four possible answers. Following is a breakdown of the exam items for each main function:

Here’s the information you asked for, formatted into a table:

| Major Job Functions | Tasks within the Job Function | % of Exam & Number of Questions |

|---|---|---|

| Function 1 | 1.1: Contacting current and potential customers; developing promotional and advertising materials and seeking appropriate approvals to distribute marketing materials 1.2: Describing investment products and services to current and potential customers | 7%, which are 9 questions |

| Function 2 | 2.1: Informing customers of the types of accounts and providing disclosures regarding various account types and restrictions 2.2: Obtaining and updating customer information and documentation, including required legal documents 2.3: Making reasonable efforts to obtain customer investment profile information 2.4: Obtaining supervisory approvals required to open accounts | 9%, which are 11 questions |

| Function 3 | 3.1: Providing customers with information about investment strategies, risks, and rewards, and communicating relevant market, investment, and research data to customers 3.2: Reviewing and analyzing customers’ investment profiles and product options to determine that investment recommendations meet applicable standards 3.3: Providing required disclosures regarding investment products and their characteristics, risks, services and expenses 3.4: Communicating with customers about account information, processing requests, and retaining documentation | 73%, which are 91 questions |

| Function 4 | 4.1: Providing current quotes 4.2: Processing and confirming customers’ transactions under regulatory requirements and informing customers of delivery obligations and settlement procedures 4.3: Informing the appropriate supervisor and assisting in the resolution of discrepancies, disputes, errors, and complaints 4.4: Addressing margin issues | 11%, which are 14 questions |

You should note that your prime focus while preparing for the exam should be the Function 3 knowledge areas. The questions from this section make up almost 73% of your exam. However, relying solely on this section is not recommended, as the passing percentage for the exam happens to be 72. Therefore relying exclusively on this section might not be the brightest of the ideas.

The Series 7 exam’s questions place a strong emphasis on “tasks” in each function. The functions are divided into four tasks related to each of the functions except for function 1, which has two related tasks.

Function 1 comprises two tasks, namely 1.1 and 1.2. These tasks delve into particular aspects of the financial industry, such as regulations, ethics, and professional conduct. By assigning these tasks, the examination aims to gauge the candidates’ ability to navigate the legal and ethical frameworks surrounding securities trading.

Function 2 encompasses four tasks labeled 2.1 through 2.4. These tasks center around different elements of securities trading and analysis. They might cover topics like investment products, market analysis, risk assessment, and portfolio management. The purpose of these tasks is to assess the candidates’ knowledge of various financial instruments and their ability to analyze market trends.

Function 3 includes four tasks designated as 3.1 through 3.4. These tasks focus on areas such as client interactions, account management, and order execution. By incorporating these tasks, the exam aims to evaluate the candidates’ skills in handling customer accounts, executing trades, and providing appropriate recommendations based on client needs and objectives.

Function 4 involves four tasks referred to as 4.1 through 4.4. These tasks explore concepts related to securities regulations, compliance procedures, and the resolution of customer complaints. By testing candidates on these tasks, the exam aims to ensure that registered representatives are knowledgeable about regulatory requirements and capable of effectively addressing customer grievances.

By structuring the Series 7 examination with a focus on specific tasks within each function, the examiners aim to comprehensively evaluate the candidates’ understanding of the relevant subject matter. This approach allows for a detailed assessment of the candidate’s skills and knowledge in various aspects of the financial industry, ensuring that registered representatives possess the necessary expertise to serve their clients and uphold regulatory standards.

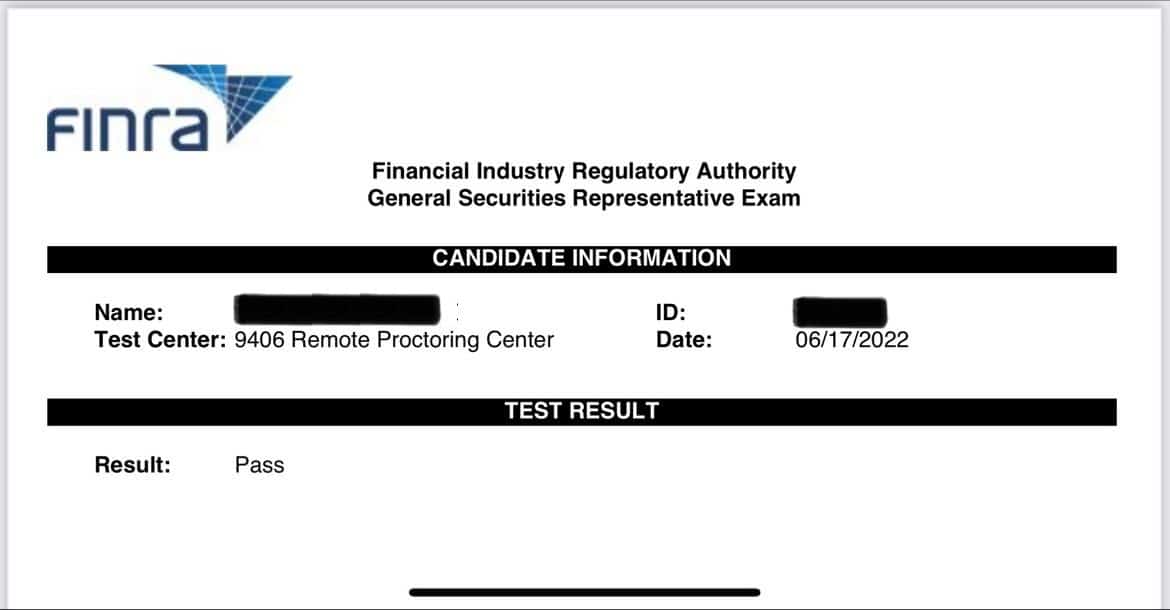

Here’s what a test taker has to say about the Series 7 exam:

“I have passed the SIE, 6, 63, 7, 66, and my state life/health exam, and the 7 was without a doubt the hardest one I took. You absolutely have to put the time in to ensure you understand each aspect of the exam.”

Source: reddit/matt2621

FINRA Series 7 Preparation Strategies

A thorough approach is required to prepare for the FINRA Series 7 test to ensure success. Your knowledge and proficiency in numerous sectors of the financial business are evaluated by this strenuous test. Here is a recommended study plan for the FINRA Series 7 test to aid your preparation:

Recognize the Format of the Exam

Learn the exam’s structure, including the number of questions, the allotted time, and the required score to pass. You get 3 hours and 45 minutes to complete the 125 multiple-choice questions on the Series 7 test. The required percentage is 72%.

Create a Study Plan

Create a study calendar and a study plan that includes the topics you’ll cover each day or each week. Based on the importance of each topic in the exam, provide enough time for it. You may stay organized and make sure you cover all the necessary topics with the aid of a well-structured study schedule.

This test taker summarized it nicely:

“Be systematic. Study every day (5 or 6 days per week) by reading the book, taking practice exams, and reading the answers and explanations of why they are right/wrong. Many of the actual exam questions are covered in the practice tests. I would study 2 hours per day (concentrated – no interruptions, no phone nearby) for 5 days a week. You should be ready to easily pass within 30 days. Overprepare so you eliminate the chance of failure.”

Source: reddit/FinancialCareers

Study the Core Concepts

Concentrate on comprehending the fundamental ideas and tenets behind the rules, products, and practices that govern the securities business. Learn about issues including customer accounts, taxes, investment methods, and ethical behavior. Use mnemonics or visualization techniques to help you remember things.

Don’t Waste Time on Technical Subjects

Spending too much effort studying topics like corporate bonds and options is unnecessary because they only make up 20% of the exam. The new Series 7 tests give clients and creating portfolios for them more importance. Testing real-world skills is becoming more popular to make sure workers are prepared to satisfy customers’ investing demands.

Think Concepts, Not Questions

Understanding the subject is more important for passing this test than memorization of the answers. Learning solutions by heart is a certain way to fail. Instead of grasping the principles, people try to remember formulas by sheer force. There is no backup plan if your memory fails you during the exam.

Practice with Sample Questions

Regularly solve practice questions to gauge your conceptual knowledge and develop test-taking abilities. Practice tests give you a feel for the examination environment and show you which subjects need more explanation. Examine your performance on practice examinations to determine your weak areas and give those subjects additional work.

Seek Additional Resources

Consider participating in online forums or study groups where you may engage with other candidates and exchange expertise and study advice. You may improve your comprehension of the subject matter by participating in conversations and expressing ideas to other people. If you want further help, you may also want to think about hiring a tutor or asking for advice from knowledgeable experts.

Review and Revise

Allocate time to review all the subjects you have studied as the exam date draws near. Pay attention to your areas of weakness and revise to ensure you understand. For a rapid review of the most important ideas, write succinct notes or make flashcards.

Simulate Exam Conditions

Take timed practice examinations before the exam to replicate the testing environment. This will enable you to adjust to the time constraints and increase your endurance for the exam itself. Pay attention to your pace and create plans for efficiently handling your time throughout the exam.

Break Down the Topics

Divide the test material into digestible chunks, then concentrate on one topic at a time. This strategy aids in keeping concentration and ensuring that each subject is fully understood before going on to the next.

Here’s what a reddit user has to say about the test:

“Study as much as you would study if your career depended on it. Go into it with that mindset (read the whole book carefully, do MANY practice questions, and 5-10+ practice tests) and it’ll be easy. It’s one annoying test, just overdo the work needed to ensure you pass. You’ll reflect on it years from now laughing at how concerned you were but glad you did it.”

Source: MBHChaotik/reddit

Utilize Various Preparation Sources

Preparation is key to passing the Series 7 Exam. Aspiring candidates should have a clear study plan, access to quality study materials, and make use of practice exams to test their knowledge and readiness. The table below lists some tips and resources that can help candidates prepare effectively for the exam.

| Tips and Resources | Description |

|---|---|

| Study Plan | Create a study plan that allocates time for reviewing content, practice exams, and revision. |

| Study Guides and Books | Use reputable study guides and books that cover the content tested in the Series 7 Exam. |

| Online Courses | Enroll in online courses specifically designed for the Series 7 Exam preparation. |

| Practice Exams | Take practice exams to simulate the testing experience and identify areas that need improvement. |

| FINRA’s Official Website | Visit FINRA’s official website for the most up-to-date information and resources on the exam. |

Test Features

Permitted Activities

If you pass the Series 7 exam you may offer, buy, sell, or solicit any securities product, including direct participation programs, municipal fund securities, corporate securities, options, variable contracts, and investment company products.

Covered activities and products include

- private placements of corporate securities (bonds and stocks) and/or public offerings

- options on mortgage-backed securities,

- government securities,

- venture capital,

- rights,

- warrants,

- sale of municipal securities and

- mutual funds,

- unit investment trusts (UITs),

- exchange-traded funds (ETFs),

- real estate investment trusts (REITs),

- money market funds,

- repos and certificates of accrual on government securities,

- direct participation programs,

- hedge funds.

Attempts Allowed

You may take the organization’s Series 7 test as many times as you choose, and no additional training is necessary. This allows candidates the opportunity to repeat the exam as many times as necessary to improve their results and increase their chances of success. However, it’s important to keep in mind that there are certain limitations.

After the first three attempts, candidates must wait six months before trying again. This provision ensures that candidates have sufficient time to study, revise their work, and hone their skills before retaking the test. Additionally, even after the first three attempts, a 30-day waiting period is mandatory.

Candidates might take advantage of this opportunity to assess their performance, identify their weak points, and take out enough time to adequately prepare for subsequent attempts.

These restrictions are intended to motivate candidates to acquire subject-matter mastery in order to increase their chances of passing the Series 7 exam effectively by pushing them to approach test preparation deliberately and comprehensively.

Employee Sponsorship

You must be sponsored by a firm that is a FINRA member (any corporation engaged in the selling of securities must be a FINRA member) to qualify for employee sponsorship under Series 7. However, you do not need to have a sponsor to take the new SIE test from FINRA. This update offers possibilities for people who desire to work in the securities industry but don’t have immediate career prospects.

Series 7 Topic Changes

The Series 7 test, which has lately undergone a lot of changes, is a prerequisite for persons who wish to operate as registered representatives in the securities industry. One crucial modification is the adoption of a new test format. The Series 7 exam originally included 250 multiple-choice questions, but it has now been altered and cut down to 135 questions to include a wider range of question types, such as interactive questions that require applicants to execute certain tasks or scenarios.

Another major change is the addition of new subjects and regulatory modifications. FINRA (Financial Industry Regulatory Authority), the organization in charge of overseeing the Series 7 examination, routinely reviews and adapts the subject matter to reflect changes in the market environment. This ensures that candidates are knowledgeable on the most recent rules, regulations, and best practices concerning securities transactions, investment products, and client interactions.

The significance of appropriateness and client safety has increased as well. The emphasis of the updated Series 7 test is that registered representatives must have a complete understanding of their clients’ financial requirements, goals, and risk tolerance. The industry’s commitment to respecting moral standards and guaranteeing that financial advice serves clients’ best interests is highlighted by this shift.

Technology has also led to changes in the Series 7 exam. With the rise in popularity of online proctoring, candidates may now take the exam remotely while maintaining test integrity. As a result, fewer physical testing sites are needed, which makes the exam more convenient for prospective professionals.

The most prevalent FINRA certification

One of the most widely used FINRA certifications is frequently thought to be the Series 7 test. Its popularity is due to several factors, including:

- Broad Authorization: People who pass the Series 7 test are authorized to carry out a variety of securities-related operations, including buying and selling securities, maintaining customer accounts, and giving financial advice. The general securities representative test is relevant to a variety of positions in the securities sector since it covers a wide range of topics.

- Industry Requirement: Many businesses in the financial services industry require a Series 7 license. For persons wishing to work as registered agents or broker-dealers, it is sometimes a prerequisite. Due to the strong demand for it, Series 7 certification is becoming more common in the business.

- Comprehensive Coverage: The rules, investment companies, stocks, debt securities, and options are among the topics covered by the Series 7 test in the domain of securities. Candidates are placed through a rigorous test that measures both their understanding of regulatory systems and their knowledge of various financial products. This wide publicity increases its prominence and ubiquity.

- Career Advancement: Having a Series 7 license paves the way for you to further your securities industry career. It makes it possible for employees to perform more demanding and skilled professions, such as managing discretionary accounts or advising institutional clients. Due to the potential for career growth and higher earnings, the Series 7 license is a desired certification for many professionals.

- Industry Recognition: The Series 7 license is well-known in the securities industry. It indicates a high degree of knowledge and proficiency in jobs involving securities. This recognition increases its ubiquity because clients and businesses routinely reward professionals who possess it.

Due to the board’s endorsement, the need for it in the business, its comprehensive coverage, the potential for professional advancement, and industry recognition, the Series 7 certification is widespread and in great demand in the financial services sector.

Technical Facts

FINRA Series 7 Fast Facts

- You will be presented with a total of 135 questions, out of which the number of scored questions is 125, and 10 of them are unscored.

- Multiple Choice Questions for most items

- Mostly administered online

- The passing mark for the FINRA Series 7 exam is 72%.

- If you want to take the FINRA Series 7 exam, you are required to be sponsored by an employer that is a FINRA member.

- You are not required to be a US citizen in order to take the exam.

Eligibility Criteria

To be eligible to take the FINRA Series 7 test, candidates must meet certain criteria set by the Financial Industry Regulatory Authority (FINRA). The Series 7 test requires the following prerequisites to be fulfilled:

- Sponsorship: You must be sponsored by a FINRA member business in order to register for the Series 7 exam. This suggests that you must work for, be affiliated with, or have a relationship with a brokerage firm, investment bank, or other financial institution that is registered with FINRA.

- Age Requirement: The Series 7 test has no explicitly specified minimum age restriction. To occupy certain jobs or register as registered representatives, the sponsoring corporation may impose its own minimum age requirements.

- Industry Essentials Exam (SIE): Candidates must pass the Securities Industry Essentials (SIE) test before taking the Series 7 test. The SIE exam is a basic knowledge test that covers the fundamental concepts of the securities industry. Passing the SIE exam confirms applicants’ fundamental understanding of the industry before taking the Series 7 examination.

- Registration and Disclosure: The necessary FINRA registration processes must be followed, and individuals must provide accurate background, employment, and any disciplinary or legal disclosure information. FINRA conducts a background check to assess a person’s suitability and eligibility for registration.

Before sitting for the Series 7 Exam, you must meet certain eligibility criteria and prerequisites. Additionally, being sponsored by a FINRA member firm is essential. This table outlines the requirements that you must fulfill in order to be eligible to take the Series 7 Exam.

| Requirement | Description |

|---|---|

| Age | Must be at least 18 years old. |

| Sponsorship | Must be sponsored by a FINRA member firm or other applicable self-regulatory organization. |

| Prerequisite Exams | Must pass the Securities Industry Essentials (SIE) exam before or concurrently with Series 7. |

| Fingerprinting | Candidates must be fingerprinted as part of the registration process. |

| Application Form | Must complete and submit the appropriate application forms, including Form U4. |

Continuing Education

For those who are registered to work in the securities sector, FINRA (the FINancial sector Regulatory Authority) has established continuing education (CE) requirements. These specifications are designed to guarantee that experts are educated about industry norms, guidelines, and best practices. The main components of FINRA continuing education are listed below:

- Regulatory Element: Registered people are required to complete a training course called the Regulatory Element. Throughout their careers, it consists of recurring training sessions to solidify their comprehension of legal requirements, sales techniques, and market advancements. The Regulatory Element’s content is determined by the person’s registration type and work duties.

- Firm Element: Broker-dealer companies are required to give their registered staff access to The Firm Element, a training course. Firms create and implement their own Firm Element plans based on the particular commercial endeavors, goods, and services they provide. To improve the knowledge and abilities of its personnel, the program must include regulatory changes, new goods, sales strategies, and other pertinent issues.

- Continuing Education Cycles: FINRA establishes specific continuing education cycles during which registered individuals must fulfill their CE requirements. These cycles typically occur every three years and are staggered based on the individual’s registration anniversary date.

- CE Requirements: The completion of required training hours throughout the appropriate cycles is one of the CE requirements for registered persons. The amount of hours necessary varies depending on the person’s registration type and work responsibilities. For instance, it is usual for general securities representatives (such as those with a Series 7 license) to finish 24 hours of CE training over the course of a three-year cycle.

- CE Providers: Courses and resources are available from FINRA-approved training companies that satisfy the CE criteria. To suit various learning styles and schedules, these suppliers provide online courses, seminars, webinars, and other training formats. To complete their CE requirements, registered persons can select from a range of certified providers.

- Reporting and Recordkeeping: Broker-dealer companies are in charge of overseeing staff adherence to CE regulations and keeping the necessary documents. Through the CRD (Central Registration Depository system), they are required to notify FINRA of the completion of CE by its staff members.

Discipline, penalties, or even registration suspension may follow failure to meet FINRA’s CE standards. As a result, in order to maintain compliance with FINRA laws, registered persons and the companies that employ them need to make sure they fulfill the CE requirements.

After passing the Series 7 Exam, registered representatives are subject to ongoing requirements to maintain their registration. This includes continuing education and compliance with regulatory standards. The table below provides an overview of the post-exam requirements and continuing education that registered representatives must comply with.

| Requirement | Description |

|---|---|

| Regulatory Element | Registered representatives must complete a Regulatory Element training program within 120 days of their second registration anniversary date and every three years thereafter. |

| Firm Element | Firms are required to annually evaluate and prioritize their training needs, and develop a written training plan for covered registered persons. |

| Annual Compliance Meeting | Registered representatives must participate in an annual compliance meeting to discuss compliance and sales practices. |

| Keeping Records and Reporting | Registered representatives must keep accurate records and report any changes in their U4 form or other relevant information. |

Maintaining the Series 7 License and License Renewal

After passing the Series 7 test, license holders are required to finish the Regulatory Element, a computer-based continuing education course, within 120 days of their license’s second anniversary.

Then, every three years, they will need to fulfill the requirements for retaining their FINRA registration in terms of continuing education.

The regulatory CE program complies with the fundamental laws and standards, including those governing sales and communication.

The Series 7 license is valid for the duration of employment with a self-regulatory organization (SRO) or FINRA-member firm. Your license will expire if you are fired from your job or quit the company and find yourself jobless for more than two years at another FINRA-member company or SRO.

Common names of the exam and disambiguation with other FINRA exams

Common names for the Series 7 test include “Series 7” and “General Securities Representative Exam.” The Series 7 test should not be confused with other FINRA examinations, as each exam has a distinct name and serves a different function. This is a critical distinction to make. Here is a quick explanation of a few of the most well-known FINRA exams:

- Series 6: The “Investment Company and Variable Contracts Products Representative Exam” is the official name of the Series 6 test. It entitles people to offer packaged financial products such as mutual funds, variable annuities, and others.

- Series 63: The Series 63 exam is officially called the “Uniform Securities Agent State Law Examination.” It assesses a candidate’s knowledge of state securities regulations and laws.

- Series 65: The Series 65 exam is officially known as the “Uniform Investment Adviser Law Examination.” It is required for individuals who want to become investment advisor representatives.

- Series 66: The Series 66 exam is officially called the “Uniform Combined State Law Examination.” It combines the Series 63 and Series 65 exams and is a common requirement for individuals seeking to become investment advisor representatives.

- Series 3: The Series 3 exam is officially known as the “National Commodities Futures Examination.” It qualifies individuals to work as commodity futures representatives and focuses on futures contracts and commodities trading.

These are just a handful of the many tests that FINRA offers. Every test has a varied topical focus and is linked to certain tasks and responsibilities within the financial sector. To pursue the right certification for a particular professional path, it is crucial to grasp the distinctive requirements and designations of each test.

| Attribute | Details |

|---|---|

| Full Name | General Securities Representative Exam (Series 7) |

| Administering Body | Financial Industry Regulatory Authority (FINRA) |

| Purpose | To assess the qualification of entry-level registered representatives. |

| Format | Multiple choice questions |

| Duration | 3 hours and 45 minutes |

| Number of Questions | 125 |

| Score Range | 0-100% |

| Passing Score | 72% |

| Frequency | Continuous testing throughout the year |

FINRA Series 7 Exam Tips

When taking the FINRA Series 7 test, it is important to take the time to comprehend the format and prerequisites of each question. Here are some helpful pointers to assist you in successfully navigating the exam:

- Read the full question before answering: Before jumping to conclusions, make sure to read the entire question carefully. Sometimes, important details or key information may be provided later in the question that can significantly impact your answer.

- Identify what the question is asking: Determine the specific requirement of the question. Are you being asked to identify a concept, calculate a value, or evaluate a scenario? Understanding the objective will guide you in selecting the most appropriate answer.

- Bring Required Documents: Make sure you have all the necessary identification and registration documents required for admission to the exam. Double-check these items the night before to avoid any last-minute surprises.

- Identify keywords and phrases: Pay attention to keywords and phrases in the question that can provide valuable clues. Look for terms like “most likely,” “best,” “least,” or “primary” that can guide you toward the correct answer choice.

- Watch out for hedge clauses, such as except and not: Hedge clauses can alter the meaning of a question, so be cautious when encountering words like “except,” “not,” or “unless.” These terms often indicate a negative or an exception to a rule, requiring you to choose the answer that does not fit the stated condition.

- Eliminate wrong answers: If you can identify one or more answer choices as incorrect, eliminate them immediately. By narrowing down your options, you increase the likelihood of selecting the correct answer. This strategy also helps you focus on the remaining choices.

- Identify synonymous terms: Look for synonyms or terms that have similar meanings to words used in the question. The exam may present different variations of the same concept, so recognizing these synonymous terms can lead you to the correct answer.

- Be wary of changing answers: While it’s essential to review your answers, avoid changing them unnecessarily. Research has shown that initial gut instincts tend to be more accurate. Only modify your answers if you have a strong reason to do so or if you have identified an error during your review.

- Use the process of elimination: If you’re unsure about a question, systematically eliminate the answer choices that you know are incorrect. This technique increases your chances of selecting the correct answer by reducing the number of options.

- Manage your time effectively: Keep track of the time during the exam to ensure you allocate enough minutes to each question. If you encounter a particularly challenging question, it’s better to make an educated guess and move on rather than spend excessive time on it and jeopardize other questions.

- Utilize Scratch Paper: The Series 7 exam allows the use of scratch paper. Use it to jot down important formulas, key concepts, or any calculations that may assist you during the exam. Organize your thoughts and eliminate unnecessary mental clutter.

- Answer Every Question: There is no penalty for guessing on the Series 7 exam, so make sure to answer every question. Even if you are unsure, eliminate obviously incorrect options and make an educated guess.

Stay Positive: Maintain a positive mindset throughout the exam. If you encounter difficult questions or feel overwhelmed, stay calm and remind yourself of the preparation you have done. Trust in your abilities and stay confident in your knowledge

Results Scale and Interpretations

Passing vs Near Passing vs Failing

Passing Score (72% or higher): Getting a 72% score or above means you’ve proven you have the skills and knowledge required to be licensed as a general securities representative. Congratulations! As a result of your exam accomplishment, you can move on with your career in the securities sector.

Near-Passing Score (68% – 71%): If your score falls between 68% and 71%, you almost aced the test but just barely failed. Even while it could be upsetting to just fall short of the passing mark, it’s crucial to keep a good attitude and utilize this failure to spur more efforts. Review your results, pinpoint your areas for growth, and think about retaking the test with a more targeted study strategy.

Failing Score (Below 68%): If your score was less than 68%, you didn’t pass the Series 7 test with a score of at least that. It’s critical to keep in mind that failing the exam is frequent and does not indicate your aptitude for success. Use this as a chance to reevaluate your study strategy, pinpoint your areas of weakness, and create a more thorough study plan for your subsequent try.

Score Reporting

Your score report will include a numerical score showing the proportion of questions successfully answered in addition to the pass/fail outcome. It’s crucial to remember that the scaling procedure has changed the relationship between the numerical score and the proportion of questions that were properly answered.

Scaled Scoring

Scaling is used on the Series 7 test to guarantee fairness and uniformity in scoring. The scaling method is used to account for changes in test difficulty levels that may exist between exam versions. The scaling technique accommodates the variations in difficulty by altering the raw scores and guarantees that the final results appropriately represent a candidate’s knowledge and performance. No matter which version of the Series 7 test a person takes, this method ensures that they will be graded fairly and consistently.

iPREP: Concise. Focused. What you need.

Sign up

Immediate access

Practice

Online self-paced

Pass

Ace that Test!

FAQs

The FINRA Series 7 exam is a licensing examination administered by the Financial Industry Regulatory Authority (FINRA) in the United States. It assesses the competency of individuals seeking to become registered representatives and engage in the solicitation, purchase, and sale of a wide range of securities products.

To be eligible for the Series 7 exam, individuals must be sponsored by a FINRA member firm or a self-regulatory organization (SRO) and be associated with that firm as a registered representative. There are no prerequisite exams required, but candidates must be at least 18 years old and comply with certain qualification criteria.

The Series 7 exam covers a broad range of topics related to securities products and their regulations. It includes subjects such as equity securities, debt securities, investment company products, options, municipal securities, direct participation programs, retirement plans, and regulatory responsibilities and ethical considerations.

The Series 7 exam consists of 125 multiple-choice questions. Candidates are given a total of 225 minutes (3 hours and 45 minutes) to complete the exam.

The passing score for the Series 7 exam is 72%. This means that candidates must correctly answer at least 72 out of the 100 scored questions to pass the exam. The remaining 25 questions are pretest questions that do not contribute to the final score.

If you fail the Series 7 exam, you can retake it after waiting for 30 days. However, if you fail three or more times in succession, you must wait an additional 180 days before taking the exam again.

The Series 7 license does not have an expiration date. However, registered representatives must keep their license active by meeting continuing education requirements and remaining associated with a FINRA member firm or SRO.

Yes, there are various study materials available to help you prepare for the Series 7 exam. These include textbooks, online courses, practice exams, and study guides. It is recommended to utilize multiple resources to enhance your understanding and improve your chances of success.

Passing the Series 7 exam opens up career opportunities as a registered representative in the financial services industry. Registered representatives may work for brokerage firms, investment banks, or financial advisory firms, where they can provide investment advice, execute trades, and assist clients in managing their investment portfolios.

In addition to the Series 7 exam, certain individuals may need to pass other exams depending on the specific activities they engage in. For example, if you wish to sell options or municipal securities, you may need to pass additional exams such as the Series 4 (Options Principal) or the Series 52 (Municipal Securities Representative) exams, respectively.

Administration

- Test Administrators: The Financial Industry Regulatory Authority (FINRA) is responsible for administering the Series 7 Exam

- Test Schedule: When an applicant signs up to take the exam, FINRA will provide a 120-day window for taking it. If you need to reschedule or cancel your appointment for the qualifying test, you must do so with at least 10 working days’ notice to avoid being charged.

- Test Format: Multiple choice on computer

- Test Materials: Candidates are not permitted to bring any reference materials to the test session. Candidates who attempt to cheat on FINRA-administered exams will be subject to severe sanctions.

- Cost: The cost of the exam has been reduced from $305 to $245.

- Retake Policy: The Series test may be retaken an unlimited number of times by candidates. However, before retaking the test, they must wait at least 30 days. They have to wait 180 days if they fail the exam three times in a row.

Test Provider

The Financial Industry Regulatory Authority (FINRA), a self-regulatory body in charge of keeping an eye on and policing brokerage companies and their registered agents, offers the Securities Industry Essentials (SIE) test. For those wishing to start or advance in the securities sector in the United States, the SIE test acts as a first knowledge evaluation. To guarantee that industry professionals satisfy the required standards and credentials, FINRA creates and conducts qualifying tests, including the SIE, as part of its regulatory responsibilities.

Information Sources

Disclaimer –Every tutoring resource and study guide on iPrep is genuine and was created with the intention of providing tutoring. The Financial Industry Regulatory Authority (FINRA), which owns the SIE exam, Series 7 exam, and any other trademarks or companies listed above are not associated with iPrep.

Free FINRA Series 7 Exam practice test: Get to know what the FINRA Series 7 Exam will be like by practicing with these sample questions:

Function 1 Sample Questions

Question 1 of 4

Which of the following types of communications requires approval before distribution?

- Retail communications

- Institutional communications

- Correspondence

- All of the above

Solution 1:

The correct answer is D: All of the above.

All types of communications, including retail communications, institutional communications, and correspondence, require approval before distribution. This ensures compliance with regulatory standards.

Question 2 of 4

When promoting investment company products and variable contracts, a general securities representative should disclose:

- The fund’s historical performance

- The fund’s management fees

- The potential risks associated with the investment

- All of the above

Solution 2:

The correct answer is D: All of the above.

When promoting investment company products and variable contracts, it is important to disclose the fund’s historical performance, the management fees charged, and the potential risks associated with the investment. This disclosure provides transparency and helps customers make informed investment decisions

Question 3 of 4

Which of the following communications requires the use of an Options Disclosure Document (ODD)?

- Research reports on stock options

- Promotional materials for exchange-traded options

- Correspondence with retail customers

- Institutional communications related to options strategies

Solution 3:

The correct answer is B: Promotional materials for exchange-traded options

When distributing promotional materials specifically related to exchange-traded options, a general securities representative must provide customers with the Options Disclosure Document (ODD). This document contains important information about the characteristics and risks associated with options trading

Question 4 of 4

When promoting municipal securities, a general securities representative should disclose:

- The issuer’s credit rating

- The potential tax advantages associated with municipal bonds

- The availability of sinking fund provisions

- All of the above

Solution 4:

The correct answer is D: All of the above

When promoting municipal securities, a general securities representative should disclose the issuer’s credit rating, the potential tax advantages associated with investing in municipal bonds, and the availability of sinking fund provisions. These disclosures provide customers with a comprehensive understanding of the risks and benefits associated with municipal securities.

Function 2 Sample Questions

Question 1 of 4

Which of the following is a permissible investment option within an employer-sponsored defined benefit plan?

- Individual stocks

- Mutual funds

- Real estate properties

- Cryptocurrencies

Solution 1:

The correct answer is B: Mutual funds.

Within an employer-sponsored defined benefit plan, permissible investment options typically include mutual funds. Defined benefit plans are typically structured to provide participants with a specified benefit upon retirement, and the plan’s investments are managed by professional fund managers.

Question 2 of 4

What is the purpose of the Know Your Customer (KYC) process in the financial industry?

- To verify the customer’s income level

- To assess the customer’s investment experience

- To identify and understand the customer’s financial needs and risk tolerance

- To determine the customer’s eligibility for tax advantages

Solution 2:

The correct answer is C: To identify and understand the customer’s financial needs and risk tolerance.

The Know Your Customer (KYC) process is a regulatory requirement that helps financial institutions understand their customers’ financial situations, investment objectives, risk tolerance, and other relevant factors. This information is crucial for providing suitable investment recommendations and ensuring compliance with regulations.

Question 3 of 4

Which regulation governs the privacy of consumer financial information and safeguarding personal information?

- FINRA Rule 2090

- Regulation S-P

- SEC Rule 15l-1

- MSRB Rule G-19

Solution 3:

The correct answer is B: Regulation S-P.

Regulation S-P, also known as the Privacy of Consumer Financial Information and Safeguarding Personal Information, is a regulation enforced by the Securities and Exchange Commission (SEC). It sets forth requirements for the collection, use, and disclosure of customer financial information by financial institutions, including broker-dealers.

Question 4 of 4

Under what circumstances may a broker-dealer refuse or restrict activity in a customer’s account?

- When the customer requests it

- When the broker-dealer anticipates a market downturn

- When the broker/dealer suspects fraudulent activity or money laundering

- When the customer’s investment objectives change

Solution 4:

The correct answer is C: When the broker-dealer suspects fraudulent activity or money laundering.

Broker-dealers have a responsibility to monitor customer accounts for suspicious activity and report any potential instances of fraud or money laundering. In such cases, a broker-dealer may refuse or restrict activity in the customer’s account to prevent further harm or ensure compliance with anti-money laundering regulations.

Function 3 Sample Questions

Question 1 of 10

Which financial statement provides information on a company’s assets, liabilities, and shareholders’ equity at a specific point in time?

- Income statement

- Balance sheet

- Statement of cash flows

- Statement of changes in equity

Solution 1:

The correct answer is B: Balance sheet.

The balance sheet provides information on a company’s assets, liabilities, and shareholders’ equity at a specific point in time, usually at the end of a reporting period. It presents a snapshot of the company’s financial position and helps assess its solvency and liquidity.

Question 2 of 10

Which ratio measures a company’s short-term liquidity and ability to meet its current obligations?

- Current ratio

- Acid test ratio

- Inventory turnover ratio

- Debt-to-equity ratio

Solution 2:

The correct answer is A: Current ratio.

The current ratio is calculated by dividing a company’s current assets by its current liabilities. It measures the company’s ability to pay its short-term obligations with its short-term assets. A higher current ratio indicates a stronger liquidity position.

Question 3 of 10

What does the price-earnings (P/E) ratio measure in equity analysis?

- The company’s profitability

- The company’s liquidity

- The company’s valuation relative to its earnings

- The company’s financial leverage

Solution 3:

The correct answer is C: The company’s valuation relative to its earnings.

The price-earnings (P/E) ratio is calculated by dividing the market price per share of a company’s stock by its earnings per share (EPS). It indicates the price investors are willing to pay for each dollar of earnings generated by the company. A higher P/E ratio suggests a higher valuation relative to earnings.

Question 4 of 10

Which investment risk refers to the risk that a bond issuer may exercise its right to redeem the bond before its maturity date?

- Call risk

- Systematic risk

- Non-systematic risk

- Reinvestment risk

Solution 4:

The correct answer is A: Call risk.

Call risk, also known as redemption risk, is the risk associated with an issuer exercising its right to redeem a bond before its scheduled maturity date. When a bond is called, investors may have to reinvest the proceeds at a potentially lower interest rate, leading to a reduction in future income.

Question 5 of 10

Which type of stock provides shareholders with a preference in the payment of dividends and liquidation proceeds?

- Common stock

- Authorized stock

- Outstanding stock

- Preferred stock

Solution 5:

The correct answer is D: Preferred stock.

Preferred stock provides shareholders with a preference in the payment of dividends and liquidation proceeds over common stockholders. Preferred shareholders generally receive fixed dividends and have priority in receiving assets in the event of liquidation.

Question 6 of 10

Which type of security represents the right to purchase additional shares of a company’s stock at a specific price for a specific period?

- Rights

- Warrants

- Options

- Convertibles

Solution 6:

The correct answer is B: Warrants.

Warrants are securities that give the holder the right to purchase additional shares of a company’s stock at a specific price (exercise price) within a specified period. Warrants are often attached to other securities as an additional incentive for investors.

Question 7 of 10

Which type of market allows investors to trade securities directly with each other without the involvement of an intermediary?

- Electronic exchanges

- Auction markets

- Over-the-counter (OTC) markets

- Dark pools of liquidity

Solution 7:

The correct answer is C: Over-the-counter (OTC) markets.

Over-the-counter (OTC) markets are decentralized markets where securities are traded directly between parties without the involvement of an organized exchange. OTC markets allow for greater flexibility in trading securities that are not listed on formal exchanges.

Question 8 of 10

Which type of investment return refers to the return generated by a security through its price appreciation?

- Capital gains

- Dividend distributions

- Tax-exempt interest

- Return of capital

Solution 8:

The correct answer is A: Capital gains.

Capital gains refer to the return generated by a security through its price appreciation over time. It represents the difference between the purchase price and the sale price of the security.

Question 9 of 10

Which fee is commonly associated with mutual funds and represents the cost of marketing and distribution expenses?

- Markups

- Commissions

- 12b-1 fees

- Mortality and expense charges

Solution 9:

The correct answer is C: 12b-1 fees.

12b-1 fees are recurring fees charged by some mutual funds to cover marketing and distribution expenses. These fees are included in the fund’s expense ratio and can reduce the investor’s overall return.

Question 10 of 10

Which type of analysis involves studying historical price and volume data to predict future price movements?

- Fundamental analysis

- Technical analysis

- Quantitative analysis

- Economic analysis

Solution 10:

The correct answer is B: Technical analysis.

Technical analysis involves studying historical price and volume data of securities to identify patterns and trends. It uses various tools and indicators, such as chart patterns and moving averages, to predict future price movements. Technical analysis focuses on the price and volume behavior of securities rather than fundamental factors.

Function 4 Sample Questions

Question 1 of 4

Which type of order instructs the broker-dealer to execute the entire order immediately or cancel the entire order?

- All-or-none (AON) order

- Fill-or-kill (FOK) order

- Immediate-or-cancel (IOC) order

- Not-held order

Solution 1:

The correct answer is B: Fill-or-kill (FOK) order.

A Fill-or-kill (FOK) order instructs the broker-dealer to execute the entire order immediately or cancel the entire order. It requires immediate and complete execution; otherwise, the order is canceled. FOK orders are typically used when investors want to ensure that their order is executed in its entirety or not at all.

Question 2 of 4

What is the role of the designated market maker (DMM) in market-making activities?

- To execute orders on behalf of customers

- To provide liquidity by quoting bid and ask prices

- To regulate trading during significant market declines

- To report transactions to regulatory authorities

Solution 2:

The correct answer is B: To provide liquidity by quoting bid and ask prices.

The designated market maker (DMM) is a market participant responsible for maintaining fair and orderly markets for specific securities. They provide liquidity by quoting bid (buy) and ask (sell) prices and facilitating trading in the assigned securities. Their role is to enhance market efficiency and provide a centralized point of contact for trading in those securities.

Question 3 of 4

Which regulatory reporting system is used for reporting corporate bond transactions?

- Trade Reporting and Compliance Engine (TRACE)

- Electronic Municipal Market Access (EMMA)

- Trade Reporting Facility (TRF)

- Real-Time Transaction Reporting System (RTRS)

Solution 3:

The correct answer is A: Trade Reporting and Compliance Engine (TRACE).

TRACE is the regulatory reporting system operated by FINRA for reporting corporate bond transactions. It requires broker-dealers to report information on transactions in eligible corporate bonds to enhance transparency in the fixed-income market.

Question 4 of 4

What is the consequence of improper handling of customer complaints?

- Fines imposed by the SEC

- Suspension of registration

- Loss of membership in self-regulatory organizations (SROs)

- All of the above

Solution 4:

The correct answer is D: All of the above.

Improper handling of customer complaints can result in various consequences. Fines may be imposed by the Securities and Exchange Commission (SEC) or self-regulatory organizations (SROs) such as FINRA. The registered representative may also face disciplinary action, including suspension or revocation of registration. In severe cases, the member firm may lose its membership in SROs, affecting its ability to operate in the securities industry. Proper handling of customer complaints is essential to maintain regulatory compliance and uphold the standards of customer protection.

You have completed the Sample Questions section.

The complete iPrep course includes full test simulations with detailed explanations and study guides.

Well done!

You have completed the Sample Questions section.

The complete iPREP course includes full test simulations with detailed explanations and study guides.

‘…TESTS THAT ACTUALLY HELP’

In the first 30 minutes of use I have learned so much more than skipping along the internet looking for free content. Don’t waste you time, pay and get tests that actually help.

Richard Rodgers

January 28, 2020 at 7:49 PM